The Ultimate Guide To Paul B Insurance

Wiki Article

Paul B Insurance for Beginners

Table of ContentsOur Paul B Insurance DiariesPaul B Insurance Fundamentals ExplainedAll about Paul B InsurancePaul B Insurance - QuestionsTop Guidelines Of Paul B InsuranceThe Single Strategy To Use For Paul B Insurance

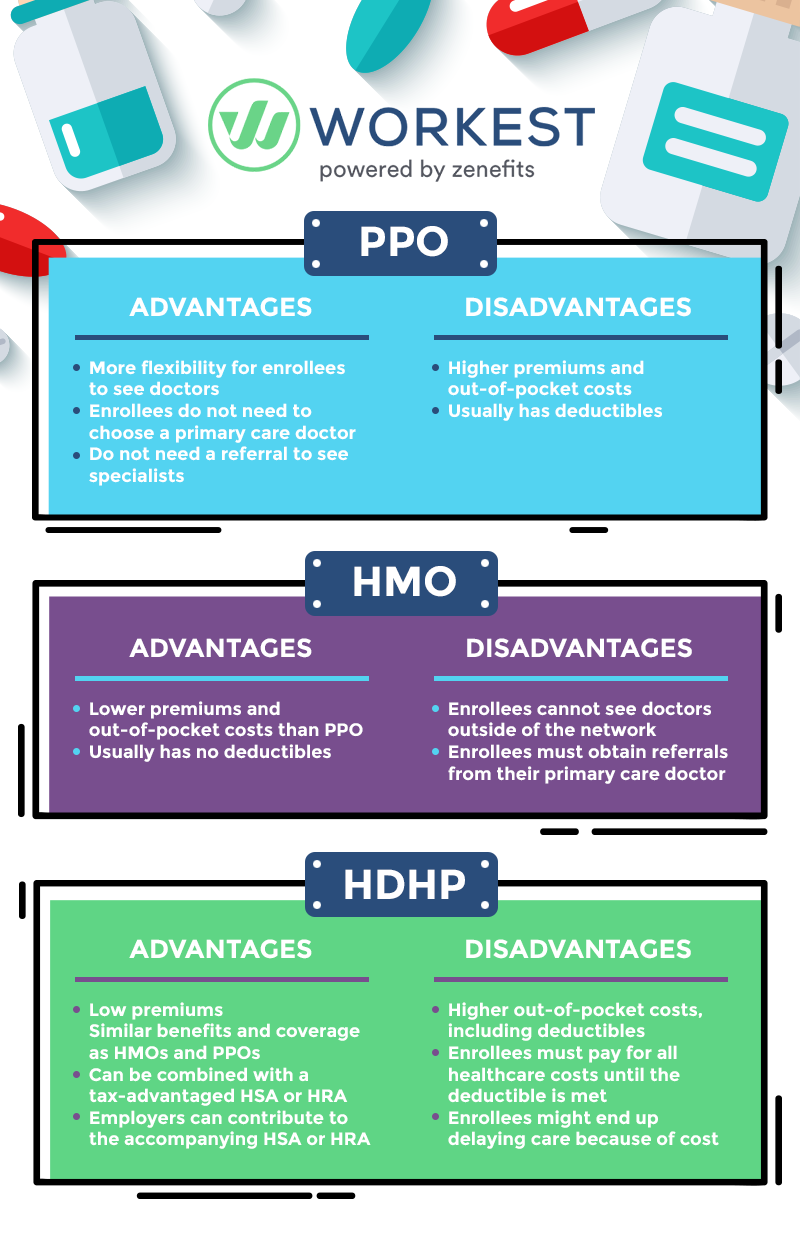

An HMO might need you to live or function in its service area to be qualified for coverage. HMOs often provide incorporated treatment and focus on prevention and health. A type of plan where you pay much less if you make use of doctors, health centers, and other healthcare carriers that belong to the plan's network.

A sort of health insurance plan where you pay less if you utilize service providers in the plan's network. You can make use of doctors, hospitals, as well as companies outside of the network without a recommendation for an added price.

, and also platinum. Bronze strategies have the least coverage, and platinum strategies have the most.

If you see a doctor that is not in the network, you'll might have to pay the complete expense on your own. This is the price you pay each month for insurance policy.

What Does Paul B Insurance Mean?

A copay is a level cost, such as $15, that you pay when you get care. Coinsurance is when you pay a percent of the charges for treatment, for example 20%. These costs vary according to your plan as well as they are counted towards your insurance deductible. There are no insurance claim forms to complete.Higher out-of-pocket costs if you see out-of-network doctors vs. in-network providers, Even more paperwork than with other strategies if you see out-of-network providers Any type of in the PPO's network; you can see out-of-network medical professionals, yet you'll pay more. This is the expense you pay monthly for insurance. Some PPOs might have an insurance deductible.

A copay is a flat fee, such as $15, that you pay when you get treatment. Coinsurance is when you pay a percent of the fees for treatment, for example 20%. If your out-of-network physician charges even more than others in the location do, you may need to pay the equilibrium after your insurance policy pays its share.

Reduced premium than a PPO supplied by the same insurer, Any kind of in the EPO's network; there is no insurance coverage for out-of-network companies. This is the expense you pay each month for insurance. Some EPOs may have an insurance deductible. A copay is a flat fee, such as $15, that you pay when you obtain care.

Paul B Insurance Things To Know Before You Buy

This is the price you pay each month for insurance coverage. Your strategy may need you to pay the quantity of an insurance deductible prior to it covers care beyond preventative solutions.We can not prevent the unanticipated from taking place, yet often we can shield ourselves and our households from the worst of the economic after effects. Four kinds of insurance coverage that many financial professionals suggest include life, health and wellness, auto, as well as long-lasting disability.

It consists of a death benefit and also a cash money worth component. As the value grows, you can access the cash by taking a finance or withdrawing funds and you can end the plan by taking the cash worth of the policy. Term life visit covers you for a collection amount of time like 10, 20, or thirty years as well as your costs continue to be secure.

2% of the American population was without insurance policy coverage in 2021, the Centers for Illness Control (CDC) reported in its National Facility for Health Statistics. More than 60% obtained their insurance coverage through a company or in the private insurance coverage market while the remainder were covered by government-subsidized programs consisting of Medicare and Medicaid, experts' benefits programs, as well as the government market developed under the Affordable Care Act.

10 Easy Facts About Paul B Insurance Explained

Investopedia/ Jake Shi Long-term handicap insurance coverage supports those who become unable to work. According to the Social Safety and security Management, one in 4 employees entering the workforce will certainly come to be disabled prior to they get to the age of retirement. While medical insurance pays for a hospital stay and clinical bills, you are commonly website here burdened with every one of the expenses that your income had actually covered.

Virtually all states require chauffeurs to have vehicle insurance policy and also minority that don't still hold chauffeurs financially in charge of any type of damage or injuries they trigger. Below are your choices when buying vehicle insurance policy: Liability insurance coverage: Pays for home damage and also injuries you create to others if you're at mistake for a mishap as well as additionally covers lawsuits costs as well as judgments or negotiations if you're filed a claim against as a result of an auto crash.

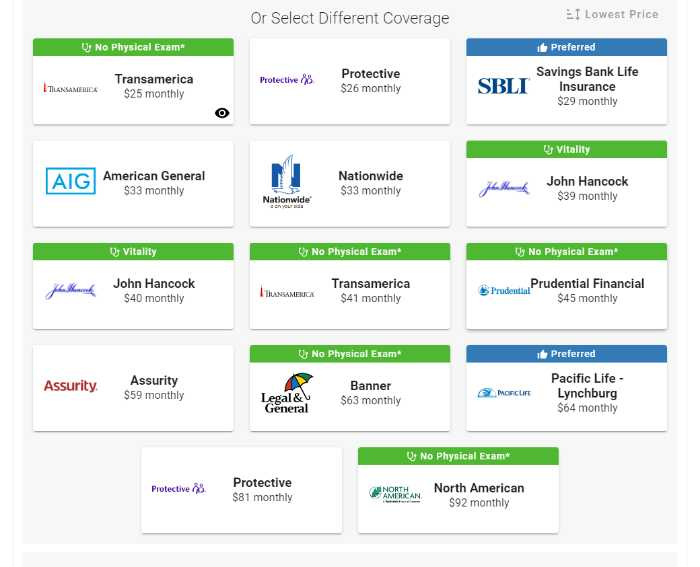

Employer insurance coverage is usually the most effective option, but if that is inaccessible, obtain quotes from numerous providers as several supply price cuts if you purchase greater than one sort of protection.

Things about Paul B Insurance

When contrasting strategies, there are a couple of elements you'll desire to think about: network, price and benefits. Look at each plan's network as well as determine if your recommended providers are in-network. If your physician is not in-network with a plan you are taking into consideration yet you wish to remain to see them, you might wish to take into consideration a various plan.Attempt to discover the one that has one of the most benefits and any type of specific medical professionals you require. The majority of employers have open registration in the fall of annually. Open up registration is when you can alter your advantage selections. For instance, you can alter click this site health insurance plan if your company provides even more than one plan.

You will need to pay the premiums yourself. ; it might set you back less than specific wellness insurance, which is insurance policy that you purchase on your own, and the advantages may be much better. If you get Federal COBRA or Cal-COBRA, you can not be denied coverage due to a medical problem.

Rumored Buzz on Paul B Insurance

Some HMOs supply a POS strategy. If your service provider refers you beyond the HMO network, your costs are covered. If you refer on your own beyond the HMO network, your protection might be rejected or coinsurance needed. Fee-for-Service strategies are commonly taken typical strategies. You can acquire the strategy, and afterwards you can see any type of medical professional at any facility.Report this wiki page