5 Simple Techniques For Paul B Insurance

Wiki Article

Paul B Insurance Things To Know Before You Get This

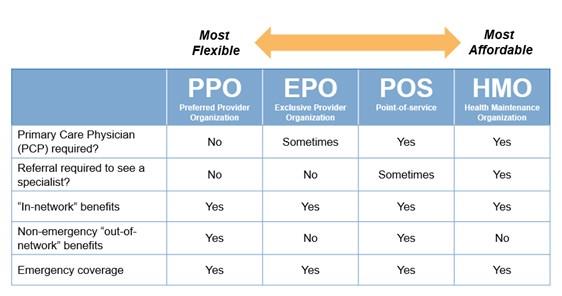

Related Topics One factor insurance policy problems can be so confounding is that the health care market is continuously transforming and also the insurance coverage prepares used by insurance companies are hard to categorize. To put it simply, the lines between HMOs, PPOs, POSs and also various other kinds of coverage are usually fuzzy. Still, recognizing the make-up of different strategy kinds will certainly be useful in reviewing your alternatives.

PPOs generally provide a broader option of providers than HMOs. Premiums might resemble or somewhat more than HMOs, and out-of-pocket costs are generally greater and much more complicated than those for HMOs. PPOs enable individuals to venture out of the provider network at their discernment as well as do not call for a reference from a health care physician.

When the insurance deductible amount is reached, extra health and wellness costs are covered in conformity with the arrangements of the medical insurance policy. For instance, a staff member could then be accountable for 10% of the costs for care received from a PPO network service provider. Deposits made to an HSA are tax-free to the company and staff member, and money not spent at the end of the year might be rolled over to pay for future clinical expenses.

The smart Trick of Paul B Insurance That Nobody is Discussing

(Employer payments need to be the exact same for all employees.) Employees would certainly be responsible for the initial $5,000 in medical costs, yet they would each have $3,000 in their individual HSA to pay for medical costs (and also would have also extra if they, as well, added to the HSA). If workers or their family members tire their $3,000 HSA quantity, they would pay the next $2,000 expense, whereupon the insurance coverage plan would begin to pay.

There is no restriction on the amount of money an employer can contribute to employee accounts, nevertheless, the accounts might not be moneyed through employee income deferments under a lunchroom plan. Additionally, employers are not allowed to refund any part of the equilibrium to staff members.

Do you understand when the most fantastic time of the year is? No, it's not Xmas. We're discussing open enrollment period, baby! That's ideal! The enchanting time of year when you obtain to contrast medical insurance prepares to see which one is appropriate for you! Okay, you obtained us.

The Paul B Insurance Ideas

Yet when it's time to pick, it is very important to understand what each plan covers, just how much it sets you back, and also where you can utilize it, right? This things can feel complex, but it's easier than it appears. We put with each other some useful knowing actions to assist you feel great about your alternatives.

Emergency situation care is commonly the exception to the rule. Pro: The Majority Of PPOs have a good option of service providers to choose from in your location.

Con: Higher premiums make PPOs extra costly than various other kinds of strategies like HMOs. A health care company is a health and wellness insurance policy plan that normally only covers treatment from medical professionals who help (or agreement with) that particular strategy.3 Unless there's an emergency situation, your strategy will certainly not pay for out-of-network care.

Not known Factual Statements About Paul B Insurance

More like Michael Phelps. The strategies are tiered according to just how much they set you back as well as what they cover: Bronze, Silver, Gold and Platinum. (Okay, it's real: The Cre did have some platinum documents and Michael Phelps never won a platinum medal at the Olympics.) Key fact: If you're eligible for "cost-sharing decreases" under the Affordable Care Act, you must pick a Silver strategy or far better to obtain those decreases.4 It's good to recognize that strategies in every classification supply some kinds of free preventive treatment, as well as some deal complimentary or reduced health care services prior to you satisfy your deductible.

Bronze plans have the lowest regular monthly costs however the highest out-of-pocket prices. As you work your means up through the Silver, Gold as well as Platinum classifications, you pay extra in premiums, yet less in deductibles as well as coinsurance. But as we stated in the past, the extra expenses in the Silver category can be reduced if you get the cost-sharing decreases.

Reductions can reduce your out-of-pocket medical care costs a great deal, so get with among our Endorsed Regional Service Providers (ELPs) that can help you figure out what you might be eligible for. The table below shows the percentage that the insurer paysand what you payfor covered costs after you satisfy your insurance deductible in each plan classification.

All About Paul B Insurance

Other expenses, commonly called "out-of-pocket" prices, can include up promptly. Points like your insurance deductible, your copay, your coinsurance quantity as well as your out-of-pocket maximum can have a large effect on the complete expense. Here are some costs to maintain close tabs on: Deductible the amount you pay prior to your insurance provider pays anything (except for cost-free preventative treatment) Copay a set amount you pay each time for points like physician sees or other services Coinsurance - the percent of medical care solutions you are Continue in charge of paying after you've struck your deductible for the year Out-of-pocket maximum the yearly restriction of what look at this now you're accountable for paying on your own Among the most effective ways to conserve money on health insurance coverage is to use find out here a high-deductible health insurance (HDHP), especially if you don't expect to consistently use clinical services.

These work quite a lot like the various other health insurance programs we defined already, but technically they're not a kind of insurance policy.

If you're trying the do it yourself route and have any type of sticking around inquiries concerning medical insurance plans, the specialists are the ones to ask. And they'll do greater than just answer your questionsthey'll likewise locate you the best rate! Or perhaps you 'd like a method to integrate getting great medical care protection with the chance to aid others in a time of demand.

The Ultimate Guide To Paul B Insurance

Our trusted partner Christian Health care Ministries (CHM) can assist you find out your choices. CHM assists families share healthcare costs like clinical examinations, maternal, hospitalization and surgery. Countless people in all 50 states have actually made use of CHM to cover their healthcare needs. And also, they're a Ramsey, Trusted partner, so you recognize they'll cover the medical bills they're intended to as well as honor your insurance coverage.

Key Concern 2 Among the points healthcare reform has carried out in the U.S. (under the Affordable Treatment Act) is to present even more standardization to insurance plan benefits. Before such standardization, the benefits provided diverse considerably from strategy to strategy. Some plans covered prescriptions, others did not.

Report this wiki page